A TAX on tourism in the Forest of Dean could be something civic chiefs consider to plug the “chronic underfunding” of public services.

Currently, in England, neither the UK Government nor local councils have the power to introduce a tourism tax.

But councils such as Manchester and Liverpool have introduced a form of tourism levy via a legal workaround.

And Forest of Dean District Council’s leader Mark Topping (G, Lydney West and Aylburton) says a tourism tax could be something “worth looking into” after 13 years of “chronic underfunding” of local authorities by central government.

The issue was considered by West Dean Parish Council at their meeting on August 30.

Parish councillors agreed to undertake further research into the issue and write up a report which will detail the pros and cons of the introduction of such a levy.

And these proposals were brought up at the district council’s meeting on October 19.

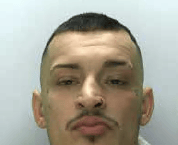

The idea has been met with scorn by Conservative councillors with Cllr Alan Preest (C, Lydney East) saying the idea is “completely ludicrous”.

Cllr Preest said: “It tells me all I need to know at this stage on the tourism tax. Our tourism providers should be very well briefed on this. I would expect at some stage to see a paper provided.

“On the West Dean Parish Council website which mentions the district council there was no business plan. It looked like some sort of spoof. We are mentioned in that West Dean parish motion.

“Have they had any dialogue with the Forest of Dean District Council on tourism tax?”

Cllr Mark Topping said they have not yet had any discussion with West Dean Parish Council over any tourism levy but he did not dismiss the idea due to the financial challenges facing all authorities.

He said: “It’s worth looking into as 13 years of chronic underfunding of [councils] mean we have to look at every sensible idea related to income generation. This is an idea.

“It may be that after we look into it, we say no, it’s not a goer. But there might be some way in which a prospering tourism sector of the economy can actually benefit the wider community.”

At present, in England, neither central government nor councils have the power to introduce a tourist tax. New legislation would be needed to allow this but the UK Government said in September this year that it has no plans to do this.

However, Manchester and Liverpool city councils, among others, have introduced a form of tourism levy via a legal workaround with an accommodation business improvement district.

In Manchester’s case the BID levy is payable by hotels and serviced apartments with a rateable value of £75,000 or more.

Like a tourist tax, the BID levy amount for individual properties is based on its occupancy.

In Manchester, it is known as the “city visitor charge” and participating businesses are encouraged to itemise it on guests’ bills.